MoneyWiz 3 - Personal Finance app for iPhone and iPad

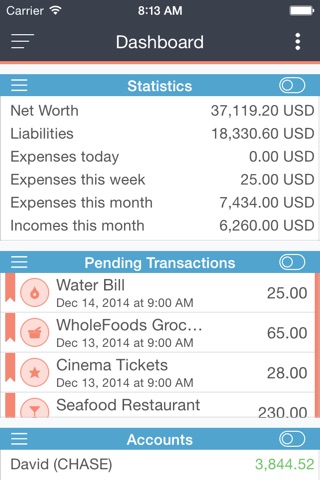

Manage everything about your money from a single app. Sync with banks or manage accounts manually. Available for all major platforms and syncs between all of your devices automatically.

FEATURES HIGHLIGHT:

• worldwide online banking support with automatic transaction categorization and access to over 18,000 banks in over 70 countries,

• crypto, forex and stock trading investment accounts with automatic trades sync,

• cross-platform sync with native apps for your desktop and mobile,

• manual transaction entry & bank statement import for those who prefer to do manual bookkeeping,

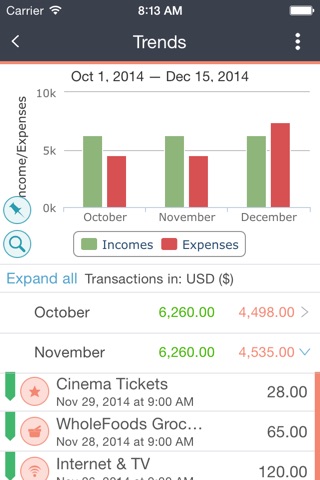

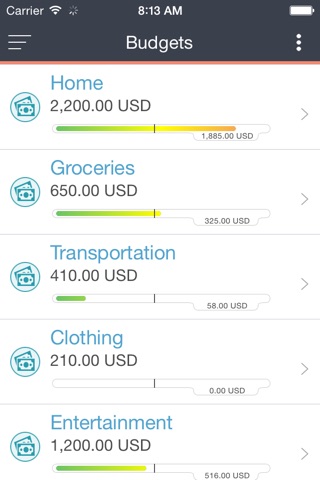

• powerful budgets, transaction scheduling, financial forecasts and reporting,

• translated into more than 20 languages, support for all world currencies, multi-level custom categories, and so much more with over 600 features!

MoneyWiz is often referred to as the “go-to” application by our customers.

Tired of comparing finance applications? Exporting data from one app to another to find the perfect one?

Trusted by hundreds of thousands of customers, MoneyWiz truly is the final destination for everyone seeking to organize their finances. Launch it, grab a beverage of your choice and start actually enjoying working with your finances!

HOT OFF THE PRESS! CRYPTO SUPPORT!

Our latest release includes support for forex and crypto-currencies. MoneyWiz is now the first finance-management application to fully support crypto-currencies trading on top of an already powerful feature set. You’re now able to see your entire portfolio, latest prices and your current net worth - all in one beautifully organized workspace!

SO HOW EXACTLY DO WE MAKE FINANCE MANAGEMENT EXCITING AND ENJOYABLE?

YOUR DATA COMES TO YOU!

With the Online Banking feature you don’t need to enter data manually (but you can!). Just connect to one of the thousands of banks we support and relax while MoneyWiz downloads and automatically categorizes transactions from your checking, credit card, savings, investment, forex and crypto accounts! On top of that, MoneyWiz uses proprietary AI algorithms to learn from your changes, so the more you use it the better auto-categorization becomes!

Not a fan of automatic online sync? Need to transfer data from another app? We’ve got you covered! You can still enter manual transactions with ease as well as import your transactions in form of CSV, QIF, OFX, QFX and MT940 files!

CROSS-DEVICE SYNC THAT WORKS

You can use our amazing SYNCbits syncing service to ensure that you have your data with you at all times, on all devices! It allows for offline use too, and automatically detects internet connection to sync any changes made while offline.

YOUR DATA STAYS YOURS

We pride ourselves in our privacy-oriented approach. Any use of online services is optional but if you do decide to use them, rest assured that your data is protected with the best safeguards and encryption methods available. Just take a look at our Privacy Policy!

Your local data also can be locked down with a PIN code (supported by fingerprint or facial authentication).

DEDICATED SUPPORT TEAM

Our support team is one of the most frequently mentioned compliments customers leave in the application reviews - and we couldn’t be prouder!

SUBSCRIPTION & PRIVACY NOTICE

We do not impose a limit on the number of accounts, budgets, regular or scheduled transactions you can create in MoneyWiz. However, you will need the MoneyWiz Premium subscription if you wish to sync other devices via SYNCbits and/or use the Online Banking feature. The subscription costs $5.99 per month, or $59.99 per year. A one month trial is available for the yearly subscription.

Your subscriptions will automatically renew each month (or year, depending on plan) and your credit card will be charged through your iTunes account. You can turn off auto-renew at any time from your iTunes account settings.

Privacy Policy: https://wiz.money/support/privacy-policy/

Terms of Use: https://wiz.money/support/terms-of-service/

Pros and cons of MoneyWiz 3 - Personal Finance app for iPhone and iPad

MoneyWiz 3 - Personal Finance app good for

Aggregates transactions from all bank accounts open in different countries and currencies (impressive coverage) as well as manual entries. Offers budgeting and reporting features. Many online transactions are correctly categorized by spending type automatically! This thing is learning your spending types and offers them later for new transactions very smartly! It allows drill down into single transaction to break up spending/income categories in the summary reports. The transactions can be edited from within the reports. Friendly interface. Professional and prompt support team. Their subscription may feel expensive but they explain on their website how most of these money go to other parties, especially to bank info aggregators. Theres lots of on-going work to make this system working. Lets all hope banks will sometime come up with a standard for data exchange ;)

Best app I used so far. My wife and I use this and always syncs correctly.

I purchased the yearly plan for unlimited transactions so I could track all of my accounts. It is very easy to set up, add transactions, and search for transactions. You can add recurring transactions and transfers between accounts in the app and pay them early (I do this for any expenses that are due for that paycheck). The app makes it really easy to budget too.

The only problem I have with this awesome app is that you cant make your budgets be based off of a % of your income

This app is great to see what youve done as well as what you have ahead of you for the week, month and year.

I am able to "pay" all my bills for the month and I am able to, then, see what I have left to play with.

I used to pay the bills on the date and then find out, "Uh oh, I have nothing left!"

App works great so far no issues with it, very useful to my every day checking needs.

Some bad moments

Dear MoneyWiz 2,

€49.99 per year for manual transactions (same as Online Banking) ... is not OK. I will keep old MoneyWiz (have deleted new one, shame I actually bought it).

If your app does not generate enough money for you then load the upfront cost but charging a monthly/annual charge for any transactions (whether auto or manual entry) smacks of greed.

I hope this review helps potential customers to look at all options.

I am deeply disappointed to discover that A subscription is required even to do a manual entries. I understand a subscription for online banking downloads however why would you charge a subscription for manual entries after having us pay for the app. Unfortunately I did not discover this until I have a loaded all my data and started going through the options and then discovered that for unlimited manual entries a subscription was required. You should state this upfront.

• No backward compatibility with version 1.0 —if you bought previous version and decide to try out a newer one — boom, your previous version on both iOS & Mac OS become unusable. One year of collecting data can kiss my shiny metal...

• Subscription based now? No kidding? Annual/monthly pay for what exactly? For common service and features? You think MoneyWiz is the only one out there on the market?

• Wishing your start-up all good and prosper. If doesnt happen, you know who to blame, right?

I bought different versions of the moneywiz2... I doesnt work at all in my phone or iPad... It simply crashes... I thought it was because I was using a previous version so I waited for the new one and nothing... It still crashes... And on top of this, I installed it in my laptop and my desktop at home and it does not synchronize.... It was a waste of my money....

Ok so saying something is the best is subjective. But I have almost every financial app in the App Store. And I keep coming back to money wiz! It has a clean user interface. Fast. Great support. Many features. If you have a Mac itll sync nicely with that! From now on Ill stop looking at other apps and just use this one! Keep up the great work!

Very intuitive in the user interface. I wish there was a way to show all items that have not cleared your bank at the end of the month and actually total them up so you dont have to still do lots of math. (If this is possible, I havent figured it out yet)

I have a data base I used to keep track of my check book and just finding not cleared items and giving me a total for those items makes balancing the checkbook so much easier, as well as eliminating the chance of me making a transposing error when doing the math. Other than that the app is very solid.

The ability to seamlessly sync between all mobile platforms, as well as, the desktop, is very handy. I also like the way reoccurring payments and deposits are handled.

I purchased this app to be able to go back and forth from Apple to Droid as my whim moved me, like that it will be cross platform.

Usually MoneyWiz 3 - Personal Finance iOS app used & searched for

mint personal finance,

crypto,

crypto pro,

mint bills,

quicken,

quicken mobile app,

mint bill,

chase mobile banking,

chase banking,

moneywiz premium - personal finance,

personal banking,

forex bank,

mint, ltd,

forex ltd,

and other. So, download free MoneyWiz 3 - Personal Finance .ipa to run this nice iOS application on iPhone and iPad.